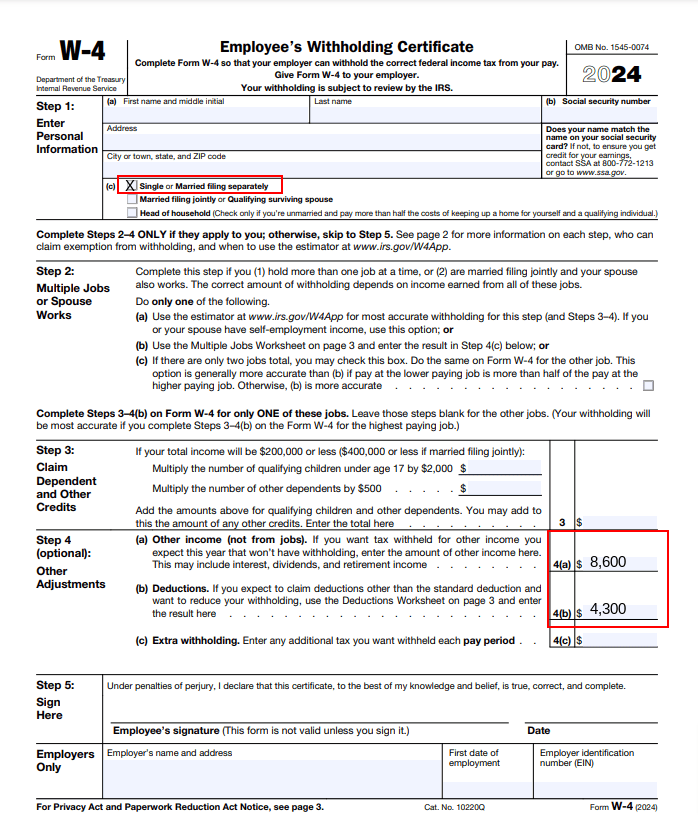

How To Complete W-4 2025 – The W-4 form is an Employee’s Withholding Allowance Certificate designed to let your employer know how much of your income to withhold for federal taxes. You should fill out a new W-4 when you have . Don’t be alarmed, on average US tax refunds are 13% lower this year. Here are ways you can receive a bigger one. .

How To Complete W-4 2025 W 4: Guide to the 2025 Tax Withholding Form NerdWallet: If you are exempt from withholding, write “exempt” in the space below step 4(c). You still need to complete steps 1 and 5. Also, you’ll need to submit a new W-4 every year if you plan to . “Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay,” the form reads. “If too little is withheld, you will generally owe tax when you file your tax .